Since the government does not ask for donations but rather takes our money in the form of taxation for necessary services, we the people should hold our elected representatives, as well as hired and appointed staff, to a higher standard of transparency in explaining why we need such-'n'-such a service, how having that service benefits us, along with the most cost effective way to provide this service.

Why am I concerned for the economic well-being of the people I serve?

The federal debt spending $7 trillion and climbing (covid).

State proposed 7 county sales tax to pay for $500 million in MPLS riot damage.

State surplus went from a $1.5 billion to a deficit of $2.5 bilion (April covid reporting) Currently the total State deficit $5 billion.

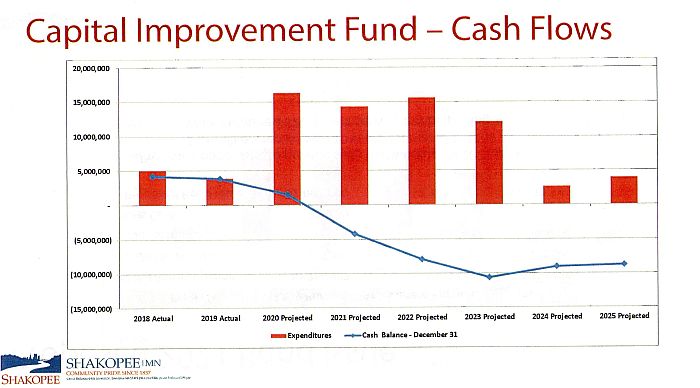

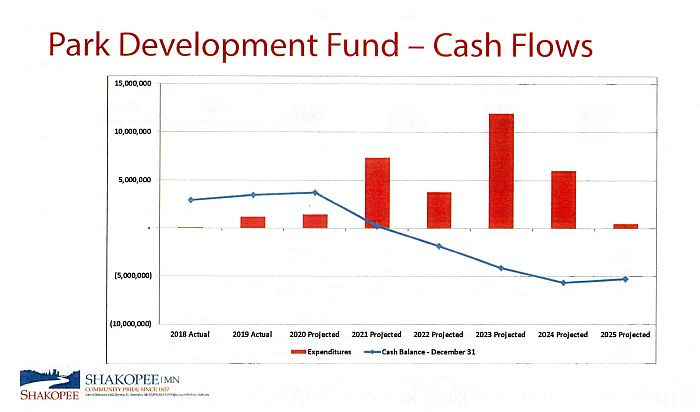

The city capital improvement fund graphs (comp plan and parks plan).

The city currently levies general taxes for park development and capital fund, looking at these graphs, the current comp plan and parks vision is not sustainable. Considering the economic impacts of Covid, what we NEED to do is focus on priority services, the stuff we actually need, and hold off on the stuff we'd like to have until the economy is better to minimize financial impacts to our residents and businesses.

This site prepared and paid for by Matt Lehman, 815 8th Ave. East, Shakopee, MN 55379